Before you read this post I want you to take a quick survey.

What do you think?

Physician Assistant vs. MD - Show Me The Money

Often the decision between PA and MD is considered a difficult one, but should it be?

Today I am posting the first in a series of posts to help prove to you why this age-old debate is not a debate at all.

And since the biggest search phrase in Google following the word "Physician Assistant" is "Salary" I thought I would start by addressing the elephant in the room and show you the numbers.

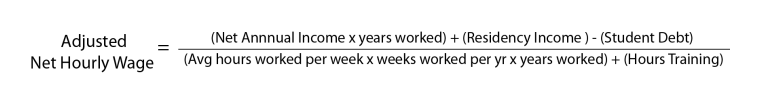

Annual salary numbers themselves are useless, as they are not a good representation of salary in relation to all the hidden variables such as time spent in training, debt, residency, and average hours worked per week.

This post is going to address all of these variables using an elegant equation and we will calculate a more important indicator:

True Hourly Wage!

This post is heavy with numbers so you may need to grab your glasses (and a calculator), but as you will see the results are interesting!

So let's get going...

Medical Doctors (MD) - True Hourly Wage

Becoming a physician is expensive!

For the 2018-2019 academic year, the average total student budget for public and private undergraduate universities was $25,890 and $52,500, respectively.

If one attends an average priced institution, receives subsidized loans and graduates in four years they will have about $33,310 of student loan debt from undergraduate college.

For the 2018-2019 academic year, the median cost of tuition and fees for public and private medical schools was $32,495 and $52,515 per year, respectively.

This does not include the cost of rent, utilities, food, transportation, health insurance, books, professional attire, licensing exams fees or residency interview expenses.

Therefore, the average medical student budget is about $55,000 per year; $40,000 for tuition and $15,000 for living expenses.

If one attends an average priced medical school, receives 1/3 subsidized loans and graduates in 4 years; at a 7% APR, statistically, they will have $200,527 of debt from medical school at graduation.

If one borrows $22,500 bi-annually and two-thirds of this accrues interest compounded bi-annually at 3.5% – their total student loan debt for both college and medical school will then be $300,527. Forbearing this debt through 5 years of residency and paying it off over 20 years will cost about $788,880 of one’s net income.

Loan repayment programs such as those offered by the military are not a solution for the majority. Each year, about 22,000 medical students graduate from U.S. allopathic and osteopathic medical schools. Each year the military matches 800 students into its residency training programs because that is the military’s anticipated future need for physicians.

The U.S. tax code allows taxpayers to deduct a maximum of $2,500 per year of student loan interest paid to their lender.

This deduction is phased out between incomes of $115,000 and $145,000. Therefore, this benefit is of no help to most physicians.

If one were to start a business, they could deduct nearly all of their expenses. Yet for unclear reasons, one cannot deduct the cost of becoming a physician; not the tuition or even the interest on the money they borrowed to pay their tuition.

During residency, if one makes payments of $1,753 per month, or $21,037 per year, to pay off the accruing interest, their debt will still be $300,527 at the end of residency.

However, they will have spent $63,111 over the course of a 3-year residency or $126,222 over the course of a 6-year residency to keep their debt from growing.

Though paying off the interest during residency is the responsible thing to do; coming up with $21,037 each year from one’s net pay of $40,000 may be quite difficult.

Time spent training, student loan debt and the U.S. tax code makes the income of physicians deceiving. A board-certified internal medicine physician who is married with 2 children, living in California and earning the median internist annual salary of $211,441 will be left with $140,939 after income taxes and $106,571 after student loan payments.

This is assuming a federal Income tax rate of 28%, California state income tax rate of 6.6%, Social Security tax rate of 6.2% and a Medicare tax rate of 1.45%.

You can go to paycheckcity.com to get an idea of what one’s net pay would be for different incomes, states of residence, marital status, the number of children, etc. Paying off a debt of $369,425 over 20 years at a 7% APR will require annual payments of $34,368.

Those student loan payments will continue to consume about $34,000 of their net income for 20 years until they are finally paid off.

What started off as $300,527 in student loan debt will end up costing $687,360. This debt that consumes one-fourth of their net income for 20 years wasn’t accrued because they bought a house they couldn’t afford – it is because they chose to become a physician.

Believe it or not, the amount of money reaching a physician’s personal bank account per hour worked is only a few dollars more than that of a high school teacher.

In order to make this calculation, we will neglect inflation of the U.S. dollar by assuming that inflation will increase at the same rate as the purchasing power of the U.S. dollar decreases.

We will also assume that physician incomes keep pace with inflation. We will also assume that tuition costs, student loan interest rates, resident stipends, physician reimbursements, and the U.S. income tax structure are as described above and do not change.

The median gross income (income before taxes) among internal medicine physicians is $230,441.

The median net income (income after taxes) for an internist who is married with two children living in California is then $191,939.

Internal medicine is a three-year residency, so throughout residency, they will earn a total net income of about $120,000 and spend about 34,000 hours training after high school.

The total cost of training including interest, forborne for three years and paid off over 20 years as explained above is $687,260.

One study reported that the average hours worked per week by practicing Internal Medicine physicians was 57 hours per week. Another study reported the mean to be 55.5 hours per week. We will use 56 hours per week and assume they work 48 weeks per year.

If they finish residency at 29 years old and retire at 65 years old they will work for 36 years at that median income.

Lets Run The Numbers:

True Hourly Wage for a Medical Doctor

[(140,939 x 36) + (120,000) – (687,260)] / [(56 x 48 x 36) + (34,000)] = $34.46

The adjusted net hourly wage for an internal medicine physician is then

$34.46 per hour

And Now The Moment You Have All Been Waiting For...

Physician Assistant - True Hourly Wage

The median gross income (income before taxes) among physician assistants is $104,760

The median net income (income after taxes) for a physician assistant who is married with two children living in California is then $76,277

Physician assistants do not have a residency. They spend about 6,400 hours training after high school plus they will need roughly 2,000 hours of direct patient care experience prior to applying to PA School. PA school is roughly 4,300 hours of training. This is made up of 2,000 hours of didactic and 2,000 hours of clinical hours plus the amount of time it takes to get a bachelor’s degree.

The total hours of training for a Physician Assistant are roughly 12,400 hours of training after high school.

The total cost of training if one attends an averaged priced institution and pays off their debt over 20 years at a 6.8% interest rate is roughly $197,176. You can estimate your own payments here.

One study reported that the average hours worked per week by a practicing Physician Assistant was 40 hours per week. Another study reported the mean to be 42 hours per week. We will use 41 hours per week and assume they work 48 weeks per year.

If they finish PA School at 27 years old and retire at 65 years old they will work for 38 years at that median income.

Since most PA's do not receive a pension we will say our hypothetical PA will get a 3% employer match for 38 years and I am going to ignore interest on this income so it is about $114,000.

Lets Run The Numbers:

True Hourly Wage for a Physician Assistant

[(76,277 x 38) + (114,000) – (197,176)] / [(41 x 48 x 38) + (12,400)] = 42.63

The adjusted net hourly wage for a Physician Assistant is then

$32.29 per hour

And Just For The Fun of it Because Both of My Parents are Teachers

True Hourly Wage - High School Teacher

The median gross income among high school teachers, including the value of benefits but excluding their pension, is about $57,720.

The median net income for a high school teacher who is married with two children living in California is then $44,791.

This is assuming a federal Income tax rate of 15%, California state income tax rate of 6.6%, Social Security tax rate of 6.2% and a Medicare tax rate of 1.45%. You can go to paycheckcity to get an idea of what one’s net pay would be for different incomes, states of residence, marital status, the number of children, etc.

Teachers spend about 6,400 hours training after high school, the amount of time it takes to get a bachelor’s degree.

The total cost of training if one attends an averaged priced institution and pays off their debt over 20 years at a 7% interest rate is $186,072.

At this income one would be able to deduct the interest on their student loans from their income taxes; however, those savings are not accounted for in the calculation below.

High school teachers have about 10 weeks off each summer, 2 weeks off during Christmas, 1 week off for spring break and 1 week of personal paid time off. Therefore, high school teachers who work a full-time average of 40 hours per week for 38 weeks each year.

Yes, teachers spend time “off the clock” preparing for class, correcting papers, etc. However, physicians also spend time “off the clock” reading, studying, going to conferences, etc. If a high school teacher finishes college at 22 years old and retires at 65 years old, they will work for 43 years.

Most teachers also receive a pension. We will assume their gross annual pension including the value of benefits is $40,000 which is a net pension of $35,507. If they die at 80 years old they will receive this pension for 15 years.

Lets Run The Numbers:

True Hourly Wage for Teacher

[(42,791 x 43) + (35,507 x 15) – (186,072)] / [(40 x 38 x 43) + (6,400)] = $31.67

The adjusted net hourly wage for a high school teacher is then

$31.67 per hour

For The Love of Money

The median gross income among internal medicine physicians is $211,441.

The median gross income among high school teachers, including the value of benefits but excluding their pension, is about $57,000 per year.

The Median gross income among physician assistants, including the value of benefits is around $115,000 per year.

Accounting for time spent training, student loan debt, years worked, hours worked per year and disproportionate income taxes – the net adjusted hourly wage of an internist is $34.46 per hour, while that of a high school teacher is $31.77 per hour and that of a physician assistant is $32.29.

Though the gross income of an internal medicine physician is 4 times that of a high school teacher, the adjusted net hourly wage of an internal medicine physician is only 1.13 times that of a high school teacher and 1.07 times more than that of a physician assistant! Click To Tweet

PA vs. MD Round 1 - goes to MD (but by an extremely narrow margin)

*Oh yeah, and how about that stay at home 35-year-old living in the basement in our poll? If anybody has time to do that calculation please post it in the comments section... We may all be working way too hard!

If you liked this post please feel free to share with a like 🙂

- Stephen Pasquini PA-C

It’s really interesting how PAs begin to compare themselves to MDs or even want to beat the hierarchy of MD. Remember, PA still carries the word “assistant behind”. If one wants to get rid of it and become a true medical doctor, please go through the intense training MDs have received during med school and residency. Personally, I have seen lots of incompetent PAs out there practicing medicine that kind of endanger the lives of patients. Luckily, they would mostly be fixed later by MDs. Just saying, MDs are much more competent in taking care of patients. And financial consideration shouldn’t be the major factor to determine which is a better career. At the end, patients lives are in our hands. Competence matters. Stay where ever you are staying and stop challenging MDs unless you are as educated as MDs.

Elephant in the Room Anyone?? First we get the sob story of the Dr. with all college loan costs and interest and interest on interest numbers flying left right and center to mystify the eyes as the $34 an hour income is revealed.

PA’s turn… Hey where did all the Education calculations go? Is someone paying for PA’s education?? Nope! Just the bait and switch of this article obviously written to deflate the Doctors income and nowhere mentioning the overcharges and other tricks Doctors use to increase their bottom line.. Hey anyone waited in office for 3 hours lately? Why? Not because your Dr had a sudden influx of emergency cases (though they might tell you that) Heck No! That’s your Dr. Booking double booking, triple booking! Then they slip the PA in to see half the patients with orders to not waste the Drs time… And they bill you the Co-Pay for the Dr visit and your insurance pays for Drs visit… PA Doesn’t see or get paid more for helping the Dr ring up 3-4 times the income that he would have had if people had a reasonable time with the Dr. and saw the DR not a PA. So for this article try increasing the Dr hourly wage 4 maybe 5 or more times to what they are really billing for. Then take that PA’s income and slash it ohh say 25% to apply the cost of learning they applied to the Dr. Now check out the “Slim” difference the article is talking about for the “Poor” Dr. Yeah Right…

The teacher calculations are inaccurate. I’m a high school English teacher considering the PA route, but that’s another story.

Anyways, the reason why teachers get summers off, get winter break, and spring break is because teachers work a 12 month job in 10 months. Personally, it would be physiologically and psychologically scarring to turn school into a 12 month job. I truly think no one would do it. I actually spent 2 weeks of the summer doing professional development, to better myself as an educator, so I claim 40 weeks of work, not 38. I won’t use that number in my example though.

Thank you for acknowledging that yes, teachers take a LOT of work home: grading student work, planning activities for the week, constructing props and teaching materials, making phone calls to parents, preparing documentation for individualized educational plans (state-mandated btw), reading resources for professional development, documenting implementation of professional development, tutoring outside of school day hours, some run extra curricular organizations, and some serve on committees for their school district.

Sure, let’s say I work just 38 weeks a year. STILL!!!! At minimum, your average teacher (not even the best or most dedicated to their profession: just your average teacher) puts in more like 50 hours of “compensated work” as you term it, and about an additional 12 hours, as cited by NEA, of non-compensated work time in other duties.

http://www.nea.org/home/12661.htm

38 weeks * (62 total actual hours work – 12 hours of non-compensated work) 50 hours a week = 1900 hours a year

1900 hours per year

$45,700 (what my actual pay stub states as my income) + $12,488 (net pension borrowed from your numbers, although I think it might work out differently in actuality, since my income is Texas-based. Just for brevity’s sake, let’s work with these numbers)

=$58188.

($58,188/62 hours of actual work)/38 weeks =

$24.69 an hour

I have roughly $24,000 dollars worth of student loans. I’m making payments of $291 a month right now. I’m locked in for the next 7 years at about 6.8% interest rate. So, 291*12 = $3492, and 38*62 =2365

Thus, $3492/$2365 = $1.47 dollars deducted from the hourly wage for the next seven years…

Your average teacher is actually making:

$23.21 an hour, assuming he/she has a much lower student loan debt than what you have calculated. I’m scared to even think about the average your using for student loan debt.

Anyways, I loved reading this article. I found it fascinating. It may even sway me more towards becoming a PA. You’re insights have a great informative and engaging web presence.

Thanks so much Alex for your excellent breakdown! It is nice to get a detailed analysis from someone like yourself who is actually working in the field. I may have to go back and update these numbers and will certainly reference your comment.

I heard a depressing statistic the other day that most teachers now a days only stay in the field for about 3 years. Do you find this to be true? My parents loved teaching but towards the end of their 30+ year careers they were fed up with much of the administrative process. Hopefully this changes, as I think teaching is a very rewarding career. In my opinion teachers should be compensated as well as doctors or lawyers.

Stephen

Stephen

You are completely missing the point, I would not choose M.D. vs PA for the economics of it, but for the level of training and how competent I will be when I come out. And it is night and day. Just take a close look at the amount of time a Medical Student spends glued to the books during the first two years of Medical School . I calculated to be the equivalent of about 34 college credit hours per semester.

And what about residency ? I was on call every third night and worked from 7 am to 5pm the following day sometimes without sleep that is a 34 hour shift. For 3 years!!! How can a PA or NP ever cover that gap in knowledge and clinical experience? It is just impossible, and that my friend, is why I went to Medical School and residency, to be COMPETENT, not to BE RICH.

I tried to do a similar comment. Thanks Alex! As an High School English teacher I concur. With 13 years experience I’m at 37k a year…also factor in paying for supplies out of pocket…I average 300-500 a year.

You don’t know what you don’t know till you become a doctor. That s what one doctor says and she used to be an NP. You shouldn’t just focus on money.

My loans were paid off in ten years not twenty. And you cannot put a price on satisfaction of being a doctor

If I could choose the Dr to be there when my life was at stake I’d pick You!

Interesting and of course it isn’t nor should be an “us vs them” mentality. What IS a problem I see with both MD owners and especially hospital admins and clinic admins is they see the PA as the “cheap doctor”. But it’s a strange relationship. They WANT to use just like they do the doctor, but they want to pay you less, yet you tend to make what they do or more, so the admins often have this resentment toward the midlevel even though they feel they can use you exactly like they do the doctor. I am not insinuating I am at that level. I AM competent, I am above the board in terms of my learning and college, but I am still NOT a doctor.

My point: PA’s are NOT cheap doctors! If we can’t be one, can’t get paid like one, then you can’t use us in the place of one. We have our role. But it has limitations even if it doesn’t seem like it in some settings

This is very true JB,

I am actually very concerned by this as well especially as I watch new graduates “thrown to the wolves” without appropriate supervision and little in the form of support or a chance to learn the trade. Many organizations see PAs as you have defined here “low cost” docs with the ability to bill patients on par with their physician counterparts. But great PAs are nurtured, and we have very little in the form of rules and regulations to make sure this is happening at an effective level. I am afraid that in our own pursuit for autonomy and increased pay we will end up shooting ourselves in the proverbial foot… Which places the reputation of our profession in danger. This is certainly a topic for discussion… on top of that new PA programs are popping up like weeds, and I hear occasional horror stories from students which shock me. So we need to be vigilant and not become careless!

Stephen

I am above the board in terms of learning and college? what does that mean?. and I am just curious to know what you think about the huge gap in classroom breath of knowledge as well as the lack of residency for a PA or NP. IT is a HUGE difference , a PA or NP will never ever have the knowledge in pharmacology, anatomy, physiology, pathology , microbiology, etc. or will ever receive the experience that a physician did during the intense clinical years that a residency provides. Don’t mean to insult your profession but comparing the degree of a NP or PA vs an MD is comparing apples and monkeys , not even in the same category.

Respect to PA’s, but serioisly someone went a long way to make themself feel better that they didn’t take the path to be a physician…

Unique way to look at the salaries though.

I think it’s time we stop thinking about the choice to study as a physician assistant as a form of “settling”, and accept it as an excellent career option in its own right!

Stephen

really? How competent do you feel vs an M.D. And how do you compare your training vs a physician that went through the intensity of Medical School and residency? Is all the extra training and classroom work useless? do we really need Medical Schools? How confident are you in pharmacology, microbiology, pathology, anatomy and physiology?

How long did you spend in direct patient care of NICU, ICU patients so you can understand the severe complications of common illnesses and obscure diseases that you may encounter and miss in the clinic? I will argue that your profession provides a cost effective alternative for healthcare but not a very competent one. You really don’t have a clue of what you don’t know.

You fit the bill of the stereotypical MD with a God complex.

A PA has a place just like a MD/DO.

Imagine what clinical life would be like without nurses?

I think we can all agree an MD is going to have to learn a lot more. But does that mean that a PA is incompetent? Absolutely not. Any MD that believes they don’t need nurses and PAs to function with fluidity has spent their head too deep in a book and too fair up their own…

And in my mind, are everything that is wrong with healthcare.

Agreed.

I work with MD/DOs and PA/NPs and the PA/NPs are called mid-level practitioners (MLP) for a reason. They are competent in many of medical aspects but have the docs available to consult on more complex cases. It helps free up the doctors to have the PAs/NPs available to for more routine scenarios, so the docs can focus on more advanced scenarios. It doesn’t lessen the competency of the MLP. I work in the ER and the docs and MLPs work together seamlessly and collaboratively. It’s really a great thing. I don’t like working with the “God complex” types just as the nurses and other support personnel don’t….They tend to carry that complex with them with everyone they encounter — patients included.

I’ve also found, from my work and as a patient, that many MLPs seem to be able to spend more time listening to me and seem to not be so rushed as so many doctors do. It comes off as more compassionate, in my honest opinion, when a provider slows down, looks away from the screen, and takes the time to actually listen and chat with the patient in a meaningful way. MLPs often have the time to this.

lol .. people dont go to med school just to get rich or make more money then a PA.

What are the pro and cons of PA vs NP? Which has a better scope of practice and more autonomy?

Why are you ignoring comments regarding your inflated values? The amount of MDs that take 20 years to pay off their debt is probably below 5%. The vast, VAST majority pay it off in 10 or less. Then you go ahead and double that? Lol..

$183,000 is the average amount of medical school debt graduates had in 2014 according to the Association of American Medical Colleges.

If a physician wanted to pay back $176,000 at 6% interest over 10 years, that would be around $1,954 a month every month for ten years. This includes nearly $58,500 in interest charges over the life of the loan.

While $2,000 a month might be a small portion of a physician’s paycheck, it is definitely not a small number in general. Consistently investing that amount in a retirement account would have massive wealth-building potential over time. Not to mention after taxes, family, mortgage, insurance and savings there will be little left.. Sorry no BMW for another 15 years. If you factor into this that doctors spend so much time in school that the lost decade of work costs a cool half-million dollars, if you assume this individual could have earned just $50,000 annually, and the typical medical school candidate is smart and successful enough to earn considerably more. Add in the time and cost it takes to pay off medical school debt and a dissatisfied physician may well consider pursuing medicine a $1 million mistake. http://www.cbsnews.com/news/1-million-mistake-becoming-a-doctor/

Don’t get me wrong, I love doctors and I appreciate everything they do but the time/money equation is not good, especially when you think about how debt affects freedom. Which in my opinion explains some of why so many doctors report being dissatisfied with their jobs:

this is awesome! Writing a paper about how supplementing more PA’s could be beneficial to the American healthcare system.

Hi Ian,

There is a lot of evidence showing how PAs bring down healthcare costs, increase patient satisfaction, decrease wait times and improve patient outcomes. Doctors are also catching on really quickly how adding PAs to the healthcare team can help the bottom line. We PAs rock 🙂

Stephen

I just wish the name physician assistant can be changed. It’s a poor choice, people who don’t know the profession continue to think is just someone that assist and no matter how you explain people are still ignorant..that’s the

big problem am having with “people “

If you do what you do because you are seeking accolades from other people your stuck. Because you can’t control other people. Changing the name of the profession may help pad the egos of PAs who feel like they are defined by their name tag. In my 13 years as a PA I have found we are defined not by the name of our profession but how we choose to go about our day. Respect is not granted by a a label… It is earned, and we each must wake up every day and earn it.

Thanks for the reply.

Hello,am so glad you posted this, am tired of reading different post of how much pa vs Md make, however am still worried if I can live comfortably as a pa in new York City. Also is it true that a pa can’t make more than 150000 yearly. Thanks

That is not true I have several colleagues that work for ortho or neuro in Kaiser (California) who are making $75/hr plus over time. They make more than 150k per year

Thanks for the reply.

A PA that can do orthopedic Surgery can make over 200k per year! The physician probably makes 500,000 dollars before taxes, though

This is a great point Sam, I think where PAs take the proverbial cake is in the triad of Family + Fitness + Freedom. And in reality, I do believe that once our financial needs are met (as a PA in orthopedics they are easy to meet) the triad takes precedence and in both the short and long term will make for a better quality of life.

– Stephen

No physician, or other highly–paid professional, in their right mind, is going to pay off that sort of debt over a period of 20 years – especially since, as you have correctly stated, they can’t write off the interest into their income taxes. Your total debt payment numbers are artificially inflated by a wide margin; that is, unless you’re talking about some sort of surgery or other extremely long residency – but, then they can expect to make a much higher income once they do finish the residency. I’m not here to argue PA vs MD, but, financially, in the long run, unless the person totally mismanages their money, the MD is going to net more by a wide margin.

I am not certain the training hours for a PA with Master’s degree are estimated correctly. It should be more unless I was not clear about the calculation. It’s 4 years college plus about 30 months for didactic classes and clinical rotations. Nevertheless, the job satisfaction from helping patients trumps the amount of money earned. One may also want to count the anxiety impact on the health about job loss and the impact of job loss on the health and family and relationships.

Oh, I really liked Jerry McGuire the movie. Cuba Gooding Jr. was simply amazing in it.

Hi Jonathan,

Studies show that happiness levels max out at around $55,0000/yr in annual salary, so money is obviously not everything. It is wonderful to have a job that impacts people in a positive way, that offers job security and a very good salary. This is why PA as a career continues to rank in the top 5 jobs year after year. Of course what we are all trading on a daily basis is time – time traded for impact, time traded for money, time traded for goods and services. And PA has a very good time – to earnings ratio – which can result in a very nice life balance.

And yes, Cuba Gooding Jr. is the man 🙂

Take care,

Stephen

So money is the only thing that matters? Such a sad state of affairs. May your soul find peace.

Of course not, time is what matters, and this is what truly separates PA from MD.

I’m still weighing out my options, but my tentative plan now is to try for PA school, and learn computer programming on the side. I feel that learning programming will enable me to make extra money and learn something different, although both are difficult paths. If I become an MD I will simply have less time to pursue side endeavors (while I am young, at least). The entrepreneurial opportunities in computer science seem to vastly outweigh those in healthcare, too. Thoughts on this? It is very difficult to make such impactful decisions.

The computer programming degree to PA path is EXACTLY the one I’m contemplating too! So many difficult choices! I would love to read any replies on the subject.

currently majoring in web design for bachelor’s and contemplating if i should do Dental School or PA school for my career choice. I know both career paths, actually all three topics are completely different, but I am a big dreamer and sometimes I go too far of into space that my friends have to bring me back to reality on earth lol did you end up finalizing your decision?

Competence is what matters, above everything else!!!

And that is what separates M.D.s from PAs LOL

You are the definition of an ass, I’d rather see a PA/NP over you anyday of the week.

I’d wager $100 that this troll is a surgeon.