Before you read this post I want you to take a quick survey.

What do you think?

Physician Assistant vs. MD - Show Me The Money

Often the decision between PA and MD is considered a difficult one, but should it be?

Today I am posting the first in a series of posts to help prove to you why this age-old debate is not a debate at all.

And since the biggest search phrase in Google following the word "Physician Assistant" is "Salary" I thought I would start by addressing the elephant in the room and show you the numbers.

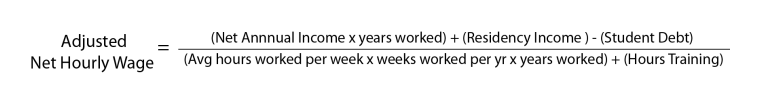

Annual salary numbers themselves are useless, as they are not a good representation of salary in relation to all the hidden variables such as time spent in training, debt, residency, and average hours worked per week.

This post is going to address all of these variables using an elegant equation and we will calculate a more important indicator:

True Hourly Wage!

This post is heavy with numbers so you may need to grab your glasses (and a calculator), but as you will see the results are interesting!

So let's get going...

Medical Doctors (MD) - True Hourly Wage

Becoming a physician is expensive!

For the 2018-2019 academic year, the average total student budget for public and private undergraduate universities was $25,890 and $52,500, respectively.

If one attends an average priced institution, receives subsidized loans and graduates in four years they will have about $33,310 of student loan debt from undergraduate college.

For the 2018-2019 academic year, the median cost of tuition and fees for public and private medical schools was $32,495 and $52,515 per year, respectively.

This does not include the cost of rent, utilities, food, transportation, health insurance, books, professional attire, licensing exams fees or residency interview expenses.

Therefore, the average medical student budget is about $55,000 per year; $40,000 for tuition and $15,000 for living expenses.

If one attends an average priced medical school, receives 1/3 subsidized loans and graduates in 4 years; at a 7% APR, statistically, they will have $200,527 of debt from medical school at graduation.

If one borrows $22,500 bi-annually and two-thirds of this accrues interest compounded bi-annually at 3.5% – their total student loan debt for both college and medical school will then be $300,527. Forbearing this debt through 5 years of residency and paying it off over 20 years will cost about $788,880 of one’s net income.

Loan repayment programs such as those offered by the military are not a solution for the majority. Each year, about 22,000 medical students graduate from U.S. allopathic and osteopathic medical schools. Each year the military matches 800 students into its residency training programs because that is the military’s anticipated future need for physicians.

The U.S. tax code allows taxpayers to deduct a maximum of $2,500 per year of student loan interest paid to their lender.

This deduction is phased out between incomes of $115,000 and $145,000. Therefore, this benefit is of no help to most physicians.

If one were to start a business, they could deduct nearly all of their expenses. Yet for unclear reasons, one cannot deduct the cost of becoming a physician; not the tuition or even the interest on the money they borrowed to pay their tuition.

During residency, if one makes payments of $1,753 per month, or $21,037 per year, to pay off the accruing interest, their debt will still be $300,527 at the end of residency.

However, they will have spent $63,111 over the course of a 3-year residency or $126,222 over the course of a 6-year residency to keep their debt from growing.

Though paying off the interest during residency is the responsible thing to do; coming up with $21,037 each year from one’s net pay of $40,000 may be quite difficult.

Time spent training, student loan debt and the U.S. tax code makes the income of physicians deceiving. A board-certified internal medicine physician who is married with 2 children, living in California and earning the median internist annual salary of $211,441 will be left with $140,939 after income taxes and $106,571 after student loan payments.

This is assuming a federal Income tax rate of 28%, California state income tax rate of 6.6%, Social Security tax rate of 6.2% and a Medicare tax rate of 1.45%.

You can go to paycheckcity.com to get an idea of what one’s net pay would be for different incomes, states of residence, marital status, the number of children, etc. Paying off a debt of $369,425 over 20 years at a 7% APR will require annual payments of $34,368.

Those student loan payments will continue to consume about $34,000 of their net income for 20 years until they are finally paid off.

What started off as $300,527 in student loan debt will end up costing $687,360. This debt that consumes one-fourth of their net income for 20 years wasn’t accrued because they bought a house they couldn’t afford – it is because they chose to become a physician.

Believe it or not, the amount of money reaching a physician’s personal bank account per hour worked is only a few dollars more than that of a high school teacher.

In order to make this calculation, we will neglect inflation of the U.S. dollar by assuming that inflation will increase at the same rate as the purchasing power of the U.S. dollar decreases.

We will also assume that physician incomes keep pace with inflation. We will also assume that tuition costs, student loan interest rates, resident stipends, physician reimbursements, and the U.S. income tax structure are as described above and do not change.

The median gross income (income before taxes) among internal medicine physicians is $230,441.

The median net income (income after taxes) for an internist who is married with two children living in California is then $191,939.

Internal medicine is a three-year residency, so throughout residency, they will earn a total net income of about $120,000 and spend about 34,000 hours training after high school.

The total cost of training including interest, forborne for three years and paid off over 20 years as explained above is $687,260.

One study reported that the average hours worked per week by practicing Internal Medicine physicians was 57 hours per week. Another study reported the mean to be 55.5 hours per week. We will use 56 hours per week and assume they work 48 weeks per year.

If they finish residency at 29 years old and retire at 65 years old they will work for 36 years at that median income.

Lets Run The Numbers:

True Hourly Wage for a Medical Doctor

[(140,939 x 36) + (120,000) – (687,260)] / [(56 x 48 x 36) + (34,000)] = $34.46

The adjusted net hourly wage for an internal medicine physician is then

$34.46 per hour

And Now The Moment You Have All Been Waiting For...

Physician Assistant - True Hourly Wage

The median gross income (income before taxes) among physician assistants is $104,760

The median net income (income after taxes) for a physician assistant who is married with two children living in California is then $76,277

Physician assistants do not have a residency. They spend about 6,400 hours training after high school plus they will need roughly 2,000 hours of direct patient care experience prior to applying to PA School. PA school is roughly 4,300 hours of training. This is made up of 2,000 hours of didactic and 2,000 hours of clinical hours plus the amount of time it takes to get a bachelor’s degree.

The total hours of training for a Physician Assistant are roughly 12,400 hours of training after high school.

The total cost of training if one attends an averaged priced institution and pays off their debt over 20 years at a 6.8% interest rate is roughly $197,176. You can estimate your own payments here.

One study reported that the average hours worked per week by a practicing Physician Assistant was 40 hours per week. Another study reported the mean to be 42 hours per week. We will use 41 hours per week and assume they work 48 weeks per year.

If they finish PA School at 27 years old and retire at 65 years old they will work for 38 years at that median income.

Since most PA's do not receive a pension we will say our hypothetical PA will get a 3% employer match for 38 years and I am going to ignore interest on this income so it is about $114,000.

Lets Run The Numbers:

True Hourly Wage for a Physician Assistant

[(76,277 x 38) + (114,000) – (197,176)] / [(41 x 48 x 38) + (12,400)] = 42.63

The adjusted net hourly wage for a Physician Assistant is then

$32.29 per hour

And Just For The Fun of it Because Both of My Parents are Teachers

True Hourly Wage - High School Teacher

The median gross income among high school teachers, including the value of benefits but excluding their pension, is about $57,720.

The median net income for a high school teacher who is married with two children living in California is then $44,791.

This is assuming a federal Income tax rate of 15%, California state income tax rate of 6.6%, Social Security tax rate of 6.2% and a Medicare tax rate of 1.45%. You can go to paycheckcity to get an idea of what one’s net pay would be for different incomes, states of residence, marital status, the number of children, etc.

Teachers spend about 6,400 hours training after high school, the amount of time it takes to get a bachelor’s degree.

The total cost of training if one attends an averaged priced institution and pays off their debt over 20 years at a 7% interest rate is $186,072.

At this income one would be able to deduct the interest on their student loans from their income taxes; however, those savings are not accounted for in the calculation below.

High school teachers have about 10 weeks off each summer, 2 weeks off during Christmas, 1 week off for spring break and 1 week of personal paid time off. Therefore, high school teachers who work a full-time average of 40 hours per week for 38 weeks each year.

Yes, teachers spend time “off the clock” preparing for class, correcting papers, etc. However, physicians also spend time “off the clock” reading, studying, going to conferences, etc. If a high school teacher finishes college at 22 years old and retires at 65 years old, they will work for 43 years.

Most teachers also receive a pension. We will assume their gross annual pension including the value of benefits is $40,000 which is a net pension of $35,507. If they die at 80 years old they will receive this pension for 15 years.

Lets Run The Numbers:

True Hourly Wage for Teacher

[(42,791 x 43) + (35,507 x 15) – (186,072)] / [(40 x 38 x 43) + (6,400)] = $31.67

The adjusted net hourly wage for a high school teacher is then

$31.67 per hour

For The Love of Money

The median gross income among internal medicine physicians is $211,441.

The median gross income among high school teachers, including the value of benefits but excluding their pension, is about $57,000 per year.

The Median gross income among physician assistants, including the value of benefits is around $115,000 per year.

Accounting for time spent training, student loan debt, years worked, hours worked per year and disproportionate income taxes – the net adjusted hourly wage of an internist is $34.46 per hour, while that of a high school teacher is $31.77 per hour and that of a physician assistant is $32.29.

Though the gross income of an internal medicine physician is 4 times that of a high school teacher, the adjusted net hourly wage of an internal medicine physician is only 1.13 times that of a high school teacher and 1.07 times more than that of a physician assistant! Click To Tweet

PA vs. MD Round 1 - goes to MD (but by an extremely narrow margin)

*Oh yeah, and how about that stay at home 35-year-old living in the basement in our poll? If anybody has time to do that calculation please post it in the comments section... We may all be working way too hard!

If you liked this post please feel free to share with a like 🙂

- Stephen Pasquini PA-C

Hi there. I am really struggling. The only two things that I have always wanted to do are practice medicine and be a mother. I have to apply within a year, and I just can’t make a decision. I realize many female MDs work full time and are amazing mothers. I fully support that, and I am happy for them. Please understand that I am not criticizing these mothers, I just know myself and I know that once I have kids, I will not be happy working full time, at least when they are young. I would have absolutely no problem in med school. I LOVE school, so that is not an issue. I am not too worried about debt; I have a full ride for undergrad and I know that whether I go MD or PA, my salary will be high enough to pay off my debt. I am mostly just concerned about lifestyle. It is important to me to be home with my family, which points me in the direction of PA school. However, I have heard that the PA field is oversaturated, and it is hard to get a job lately because the profession is becoming more popular. I have heard it is especially hard in Missouri, specifically St. Louis, as this region generally prefers NPs. Is this true? I am hearing so many things and would love if you could weigh in. Thank you in advance.

Hi Erin, I can tell you have given this a tremendous amount of consideration, so I am sure you will make the best decision for your situation. As a family practice PA working in California, I am always blown away when people mention that PAs are having trouble finding jobs in various parts of the country. The healthcare shortage is profound, so I find it hard to believe that the PA profession is saturated anywhere. But is that the case in Missouri? You may know better than I! I receive recruitment letters weekly from all types of specialties offering competitive salaries, relocation bonuses, and great benefits. The job market, according to the oft-quoted Bureau of Labor Statistics National Occupational Outlook Handbook, predicts a 31% increase over the next ten years. In California, we have been gaining ground on NPs even in family practice, and I notice the County of Santa Cruz, CA where I work (which has notoriously been bullish on NPs) has been hiring many PAs… I like to think it is because of our amazing track record.? As far as family is concerned, my partner and I have raised two children now, ages 12 and 14, as part of a healthcare family (my wife is an RN, and I am a PA), and I wouldn’t change it for the world. I know several MDs who I work with who have been integral in their children’s lives and raised very happy children, and I am fairly sure they would also say they wouldn’t have changed a thing. The one caveat here is choosing the right specialty. I think this applies to both the PA and the MD profession. Avoid surgical subspecialties if you want to be happy and part of your children’s precious childhoods. In my experience, the on-call hours and the constant grind can be exceedingly difficult to maintain while prioritizing your family. Maybe somebody else would like to weigh in on this, but that is my experience and I have seen many MDs (and PAs) lives upended because of it.

Stephen

I an currently a undergraduate student trying to figure out which route is best for me. I want to be able to build/maintain a family. I am trying to decide between NP, PA, or MD. My specialties will likely be between Obstetrics Gynecology (the more likely option), Pediatrics, or maybe even Dermatology. I am confused because when I look up average salaries it sometimes says that Nurse Practitioners make more than Physician Assistants and that they have more Autonomy, even though I also read that it varies by state. I want to be able to deliver babies and have independence. I like working in groups sometimes. I imagine myself actually working with the patient and being there for them. I could see myself being in states like CA, GA, FL, NC. Where would you recommend I do? I don’t want to be overworked which I heard is the case for nursing positions. But in my desired specialty there are barely any PA positions that will allow them to help birth babies. HELP!

Hi Alexis,

Have you investigated nurse-midwifery as an option? Just want to add a bit more to your confusion :-)… Take a look into this and let me know your thoughts.

Stephen

Stephen,

Thank you for writing this post. It truly helped me decide to be a PA instead of a MD.

I like to help people too, and I also want to have a life and hobbies outside of my career. It is great to read what you wrote!

Current loan interest can be consolidated under 4% (3.75 last offer I received in mail).

Specialty matters, this calculation is for primary care specialist.

For someone nervous about carrying debt, PA school is an easy decision….. but you need to apply and qualify. It may be easier to get in, so that is also a stress relief, but you may need to broaden WHERE you are willing to receive your training.

Loan repayment programs are changing, most recently the CA loan repayment program for primary care doctors will help pay up to 300K in educational debt! This applies to primary care, let’s face it, specialists salaries are much higher, and they can afford to pay their loans.

Many employers are able to offer loan repayment as additional salary benefit, so educational debt really should not be the reason to not choose Medical school.

Time for training, location, family, and ultimately work life are all real. The is a major trend supporting PA training and the job availability is plentiful.

The ability to find employment where you want to live is definitely favorable…. and you can change specialties as a PA because your not tied to board certified training limiting your job opportunities.

Physicians comp varies greatly. PCP is at the bottom tier, then academic vs employed vs private practice as well as geographic region. For Family Medicine, your logic makes relatively good sense.

However, add two more years residency/fellowship and the board certification and compensation skyrocket. Both starting comp and average comp are at least double. Easily in reach is over $500k plus large retirement plan opportunities. It is competitive and sacrifices are made. PA’s have much more limited upside. Read Medscape physician compensation surveys.

I am seriously considering the PA route. However, I am leaning heavily into the research aspect of the career… I want to research new ways to treat the brain. I have no initiatives for creating/maintaining a family, don’t mind dashing upwards of a 60+ workweek, and want to pour myself into the concepts of neurology, neuropathology and perhaps a touch of psychiatry. Also, employment autonomy and being the “final word” are important to me in a salient decision-making team. For these “personal” reasons, a lot of people suggest I should go MD or DO. Do you agree?

Hi Cole, yes, I agree that you would probably be better off (and happier) pursuing your MD and going into research as you have suggested. And what better place than in the field of neuroscience!! You will never be bored!

Stephen

MD for research, maybe even MD/ PhD! Most combined PhD programs will pay your MD educational debt

Why not just “Why my wife is happy I am a Physician Assistant”? Do we need to downgrade another profession just to further validate our own?

PA can be the perfect profession for some, but not for others. Also it turns out that no PA working today would have the ability to work without a supervising MD. We need great doctors! Future healthcare providers need to know all of their options when choosing a career path – and should be educated on it. But he/she should be making this decision on his/her own.

Disclaimer: I am a PA and I love my job!

This isn’t how things work in real life. Doctors work more and make more than teachers and PAs- let’s not use numbers to fabricate reality here.

I was wondering if someone was going to bring up REALITY in response to this obviously biased article. I am a college advisor and previous high school teacher, and my husband is currently pursuing medical school. We’ve done the math, and these numbers are way off because of faulty assumptions. One such huge assumption is that all doctors make and stay at around $210K/year. Not even close to true, especially when you get into different specialties. Another faulty assumption is that a doctor is going to take the maximum amount of time to pay off student debt, and that they have debt from their bachelor’s as well. Both would be wrong in most cases. The entire teacher’s salary calculations are waaaay off due to many factors, and I would know. This guy can’t possibly think that a high school teacher takes home within $3 of what a doctor makes, accounting for all the factors he is (mistakenly) taking into account. With the type of mathematical logic he’s using, I’m surprised at his education level. Doctors make way more than teachers, and much more than PAs as well. Let’s not fool ourselves. All one has to do is look at their differing socioeconomic lifestyles, net worths, and assets to know that. We could have saved him making up data to fit this narrative.

All good points Melissa and you are right…

– “One such huge assumption is that all doctors make and stay at around $210K/year. Not even close to true, especially when you get into different specialties.” Yes, for a doctor pursuing surgical subspecialties it is common to make well over 400-600k per year.

– “Another faulty assumption is that a doctor is going to take the maximum amount of time to pay off student debt and that they have debt from their bachelor’s as well.” Yes, if you are able to fund school without accruing debt this will create a much more favorable situation (for both the teacher and the doctor)

In the end, all financial breakdowns and comparisons are going to depend on a multitude of factors that have nothing (or very little) to do with the cost and length of education and the average pay scale. One can become just as trapped while playing a game of lifestyle inflation and hedonic adaptation making 20 million dollars a year. Just look at so many artists who have found themselves bankrupt at a very young age! The truth is if you play your cards right and educate yourself on finance at an early age you can make decisions that will help you attain your goals whatever they are. Whether that is working in the Peace Corps as a doctor, helping inner-city youth as a teacher, becoming a college professor, or opening a business as a plumber, working on the NY stock exchange, or even retiring early to a sunny beachside in the Bahamas.

Thanks for your comment, I am sure your students are lucky to have you as their college advisor!!

Warmly,

Stephen Pasquini PA-C

http://www.smartypance.com

http://www.thepalife.com

I have 2 major bones to pick with your calculations.

1.) PAs get employer matching contributions, teachers get a pension, yet physicians get nothing? This is unlikely and unrealistic. Give the physician 3% match and this will add a cool $250k ($230k x 3% x 36 years) to the numerator.

2.) MD training is 34,000 hours and PA training is 12,400? I am curious how you pulled 34,000 out of thin air. 6,400 for undergrad (consistent your other two career choices) and 3 x 3,000 (80 x 30 + 40 x 15 + 0 x 8) hours for residency (3 years since you are assuming the salary of a IM physician with a 4+2 schedule working 80 hours /week during IP blocks and 40 hrs/week during OP blocks plus 4 weeks for vacation and 4 weeks for “research” if pursuing a specialty but since the assumed doctor will not specialize this research time will be spent researching Netflix’s catalog of movies and shows). This leaves about 18,000 hours spent in medical school? Unlikely and terrible assumption. The first 2 years of medical school is about 4,000 hours and the last 2 years take up no more than 3,000 hours of “training” for didactic/clinical work. The denominator should really be reduced by about 10,000 hours.

Make these realistic adjustments and MD earnings will dwarf a PA’s earnings.

Even the least ambitious MDs will blow your average PA out of the water. I hope PAs are never allowed to work independently of MDs. Honestly a MD should have been required to sign off on this pathetic work of yours.

Your mother should have been required to sign off on your ability to access the Internet. She either failed to teach you how to disagree cordially or you lack basic social skills. Grow up.

I have 500 k debt.

I will pay 250 k in total and loans will be forgiven… this is via pslf.

I am internal medicine.

I made 420 k 2021 and expect to push 500 k this year.

PA vs doctor aren’t even close for pay. Both great fields but not close.

I read your article, and it was interesting to say the least. However, there was one small error…and because your parents are teachers you should know…that teachers rarely work fourty hours a week. I’m and English teacher in Kansas. My yearly income is 37000. I work Monday-Friday, but my day starts at 7:30 and I leave the building at 4:30 on a good day. I don’t get bathroom breaks, coffee breaks, and if a fight breaks out on my way to lunch…I don’t get my 25 minutes to snarf food. I also spend two to three hours a night at home grading, planning, and writing tests and lessons at least three days a week. I also must read and re read everything I as my students to read. I am also required to attend workshops and seminars often on the summers. Then couple in the students who I care about showing up to school sick, scared, or worse and worries come home with me. Please also remmwber I don’t get off everyday your child does. I have in-service days, parent teacher conferences, and work days. You job is critical don’t get me wrong. Your college costs are astronomical I agree. I also spend at a minimum 400.00 a year out of my own pocket for items needed in my classroom. Teachers work an average of 51 hours a week for fourty weeks. That translates into 39.2 hours a week for 52 weeks. Then you get you hourly wage of 15.45 per hour and I didn’t calculate for my student debt. I’ve paid 150.00 a month for the past 13 years and have 33k left to go and…I didn’t subtract my out of pocket expenses from my salary. Just saying I’m not a mathematician but your numbers might be off. Show me a teacher who works only 40 hours and only works 38 weeks a year.

I want to thank you for sharing this. I am a second year college student majoring in biology and I frequently go back and forth between whether I want to go to PA school or Med school next. As a girl I tend to think a lot about the family aspect, as I wish to have all my kids before the age of 35, and be able to be a mother who is able to be around a lot as my kids grow up. This just made me about 90% sure that I want to be a PA (which is the most sure I’ve ever been). Thank you again 🙂

Hi, SK, I am glad I was able to nudge you in the right direction! I am pretty biased, but in today’s medical climate, I think it’s safe to say that you’re making the right decision. Let me know if you ever have any questions.

Stephen

I was fortunate enough to have medical school payed by my parents so I earn tons more. My father was a physician so he could afford it in the old days. My son is going to go to Med School in 2018 and I can afford to pay his entire tuition. Doctors are often a family trade just like fireman, so keep it in the family or forget it from a monitary stand point

Good advice David, I am sure a vast majority of those who want to be doctors are not doing it for the money, nor should they. It is good to have that validated.

Stephen

Thank you for this fascinating and insightful analysis. many people both MD and PA are not aware of the actual return on investment of their time, money, emotional strength, health etc required in training and work. either over or underestimating it.

I request that you analyze the cost/revenue provided by the MD and PA training career track much as you have done, but with the following aim: to arrive at a number for the future value which results from each track. that is, viewing each track purely as an investment. I would be interested in seeing a future value at the time of say 10 years into post training practice, and at retirement age. thus answering the question, if you undertake this track, what value will be created at the 10th year of practice and at retirement. feel free to ignore taxes and inflation.

my son is interested in ortho and I want him to realize the actual cost so as to make an informed decision.

Interesting take on income from an hourly perspective! That’s crazy that the hourly difference is so narrow!

Also, Dr. Terry, I’ve actually done exactly what you asked for except for a family practice doctor. (Your ortho son would be better off financially than the family practice doc.) I used some info on PA’s on this website to do it.

I compared the salary at every age for a family practice doctor vs a PA after taking into account taxes, debt payments, and investing for retirement. I even did 2 scenarios: a financially conscious PA/doc and a not financially conscious PA/doc.

I did this because I never really knew if a PA or family practice doctor was better off financially.

Check it out if you’re still curious https://financingmedicine.com/2017/08/22/pa-vs-family-practice-doctor-financial-perspective/

Hi, Terry,

Orthopedics is much more “profitable” than general practitioners. In fact, I know some orthopedic MDs who make well over 500-600K per year. Of course, time and quality of life is a big factor here as well. Specialty orthopedic PAs can make around 125k-150k per year. If an MD works for an organization the numbers are lower but probably still in the 200-300k and you don’t have all the stress of running a practice. I also think Osteopathy is an interesting choice especially for people interested in orthopedics.

Stephen

After reading all this I’m kind of glad I did Engineering.

Cost of bachelors in Aerospace Engineering – $6000 (Loan I took out to go summer school. Rest of tuition was paid by scholarship and grant)

I have been working for 5 years now and my salary now is -$92,000

Then again not everyone goes to become a doctor for the money. They want to help people so it’s about personal preference and satisfaction at end.

I agree completely, although I know a doctor who has both his engineering degree and is an ortho spine surgeon, so I guess there is some overlap here 🙂